10 Ways to Maximize Your Potential Gains in Crypto Margin Trading

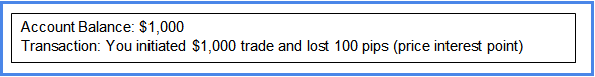

Leveraged trading or margin trading is well-thought-out as speculative. When it comes to crypto, others see it as a risky type of trading. But, worry not. Here are ten must-read tips before you embark to your first crypto margin trade. These will help you, as an investor, to hone your trading skills and market understanding. Good luck!- Start with Small Amounts

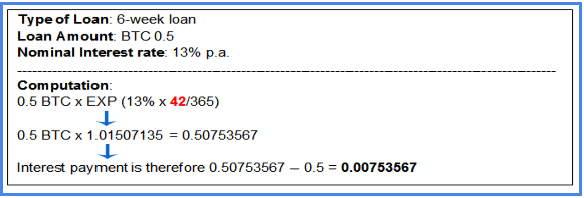

- Be Aware of the Interest Rates and Conditions

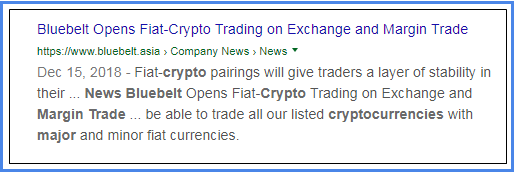

- Get Used to Major News, Events, and Outcomes

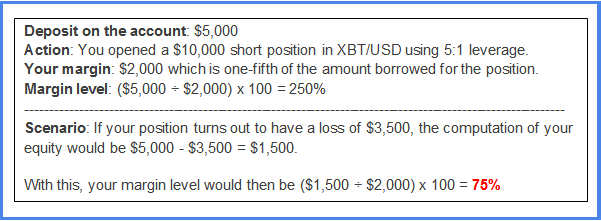

- Pay Attention to the Liquidation Price

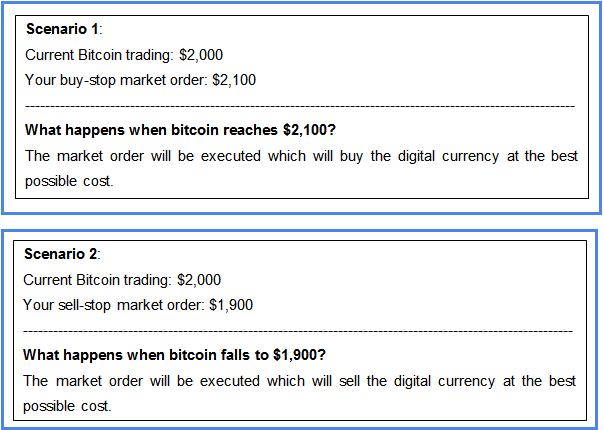

- Utilize a Stop Loss

- Control a Profitable Trade

- Secure Backup Funds

- Stick to Your Plan

- Observe Your Positions

- Crypto trading is like a game at the Casino. You can either gain money or lose money. So, you should not rely on speculation without proper research in making trades. Even in gambling, for you to win the game, you must have a strategy and should observe the condition of your opponent.

- If you want to secure your backup funds, keep them in cold storage — an offline wallet. Through this, only the amount that you need to trade is available on the exchange. Since your backup funds remain in place, you have confidence. If any mishap happens like if the exchange is hacked, you have a guarantee that you have some extra funds to continue your trades.

- If you encounter a mistake, don’t think that it’s a total loss. Use it to learn by evaluating the scenario and gauge why it happened. You must take it as an asset for your next move —you know more now than before.