FIVE Most Common Mistakes Done by New Crypto Users

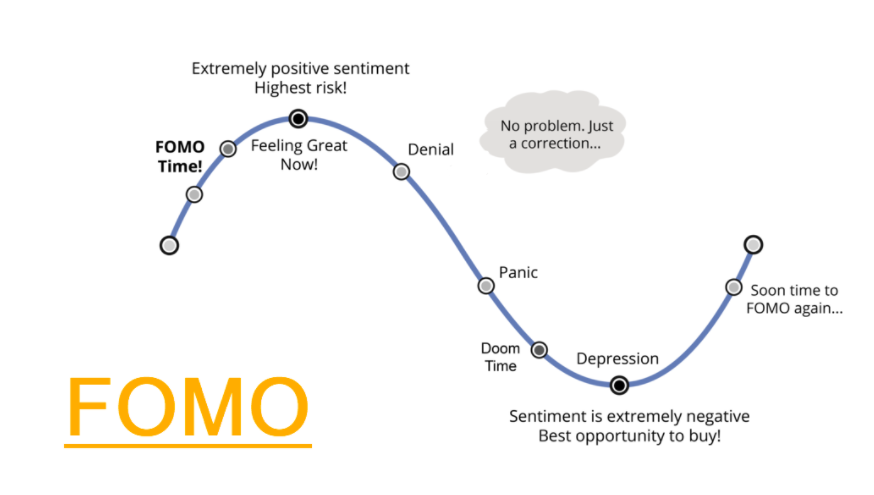

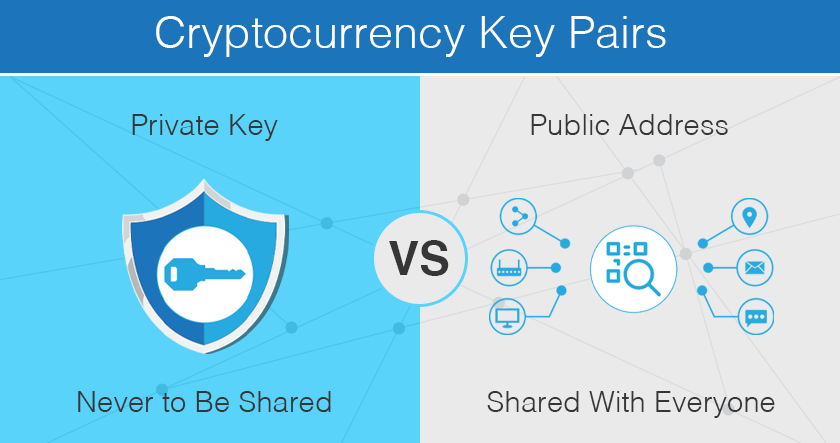

Image by Cryptocurrency ArmyThe crypto community is an unregulated market and community where anarchy prevails. The whole market is divided into “tribal” communities, each following a specific type of coin or token.When the ICO craze reached its peak back in 2017, so many newbies were dragged into scam communities. Of course, most of them lost quite some money for different reasons. Some gave away their keys, others just didn’t get what they paid for.To unprepared people, the crypto landscape can be very dangerous, but the key is to find trustworthy communities whose members actually look out for each other. Serious communities like these put enough effort into improving their branding and marketing, to the point that even traditional news outlets and financial institutions acknowledge their credibility.And of course, no decent community will always tell you to do research. Bad communities, on the other hand, will want you to stay ignorant and dumb.4 – Acting out of FOMO (Fear Of Missing Out)

Image by Cryptocurrency ArmyThe crypto community is an unregulated market and community where anarchy prevails. The whole market is divided into “tribal” communities, each following a specific type of coin or token.When the ICO craze reached its peak back in 2017, so many newbies were dragged into scam communities. Of course, most of them lost quite some money for different reasons. Some gave away their keys, others just didn’t get what they paid for.To unprepared people, the crypto landscape can be very dangerous, but the key is to find trustworthy communities whose members actually look out for each other. Serious communities like these put enough effort into improving their branding and marketing, to the point that even traditional news outlets and financial institutions acknowledge their credibility.And of course, no decent community will always tell you to do research. Bad communities, on the other hand, will want you to stay ignorant and dumb.4 – Acting out of FOMO (Fear Of Missing Out)